View:

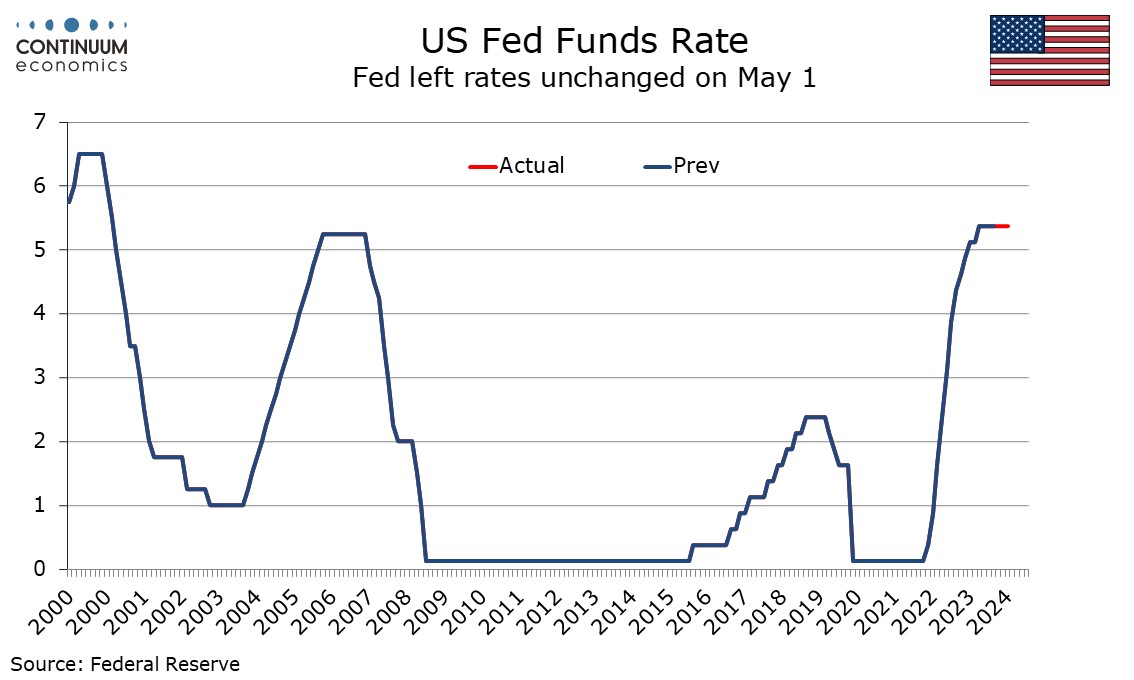

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

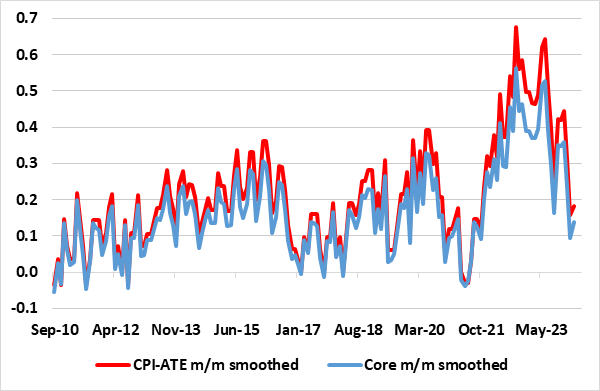

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

China: Q1 Upside Surprise, but March Disappoints

April 16, 2024 8:33 AM UTC

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail s

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

Indonesia CPI Review: Inflation Inches Down but BI on Alert

May 3, 2024 10:33 AM UTC

Indonesia’s consumer price inflation eased marginally to 3% yr/yr in April on the back of declining food prices. Despite the easing, food price remain the key inflationary factor. Additionally, imported inflation as the IDR comes under pressure could keep inflation elevated in the near term. Bank

FX Daily Strategy: N America, May 3rd

May 3, 2024 9:04 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

Norges Bank Review: Even More Caution?

May 3, 2024 8:46 AM UTC

Surprising few, the Norges Bank Board left the policy rate at 4.5% for a third successive meeting at its latest Board meeting. It also retained the thinking first aired at the December meeting, namely ‘policy to stay on hold for some time ahead’ rhetoric, this more formally evident in what wer

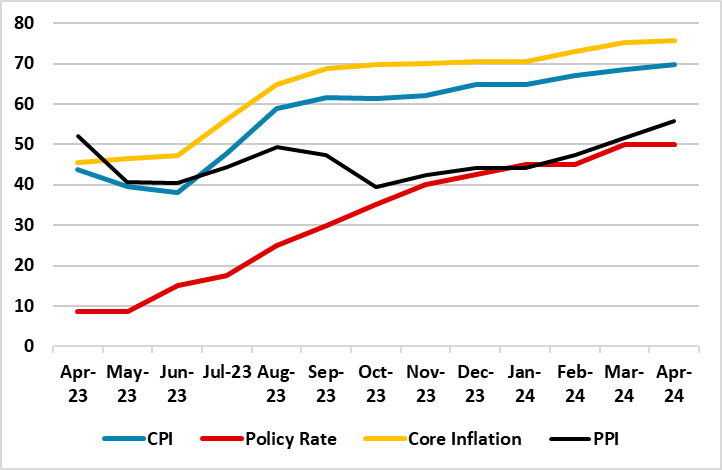

Turkiye’s Inflation Continues to Jump in April with 69.8%

May 3, 2024 7:40 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 3 that Turkish CPI ticked up 69.8% annually and 3.2% monthly in April due to increases in transportation, restaurant & hotel and education prices, coupled with the lingering impacts of the wage hikes on the services sector. We feel u

FX Daily Strategy: Europe, May 3rd

May 3, 2024 5:57 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

Asia Open - Overnight Highlights

May 3, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly stronger against the USD as the greenback continue to drift lower after the less hawkish than expected FOMC. IDR saw the largest gains of 0.46%, followed by KRW 0.45%, SGD 0.44%, PHP 0.4%, CNH 0.39%, MYR 0.38%, THB 0.29%, TWD 0.18% and HKD 0.13%.

USD/CNH is t

FX Daily Strategy: Asia, May 3rd

May 2, 2024 9:00 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

FX Daily Strategy: APAC, May 3rd

May 2, 2024 3:12 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady