View:

May 03, 2024

Asia Open - Overnight Highlights

May 3, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly stronger against the USD as the greenback continue to drift lower after the less hawkish than expected FOMC. IDR saw the largest gains of 0.46%, followed by KRW 0.45%, SGD 0.44%, PHP 0.4%, CNH 0.39%, MYR 0.38%, THB 0.29%, TWD 0.18% and HKD 0.13%.

USD/CNH is t

May 02, 2024

FX Daily Strategy: Asia, May 3rd

May 2, 2024 9:00 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

FX Daily Strategy: APAC, May 3rd

May 2, 2024 3:12 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

Preview: Due May 3 - U.S. April ISM Services - A correction after two straight slowings

May 2, 2024 2:14 PM UTC

We expect April’s ISM services index to see a modest increase to 52.0 from 51.6, pausing after two straight declines, leaving the index with no clear trend, and continuing to imply modest expansion.

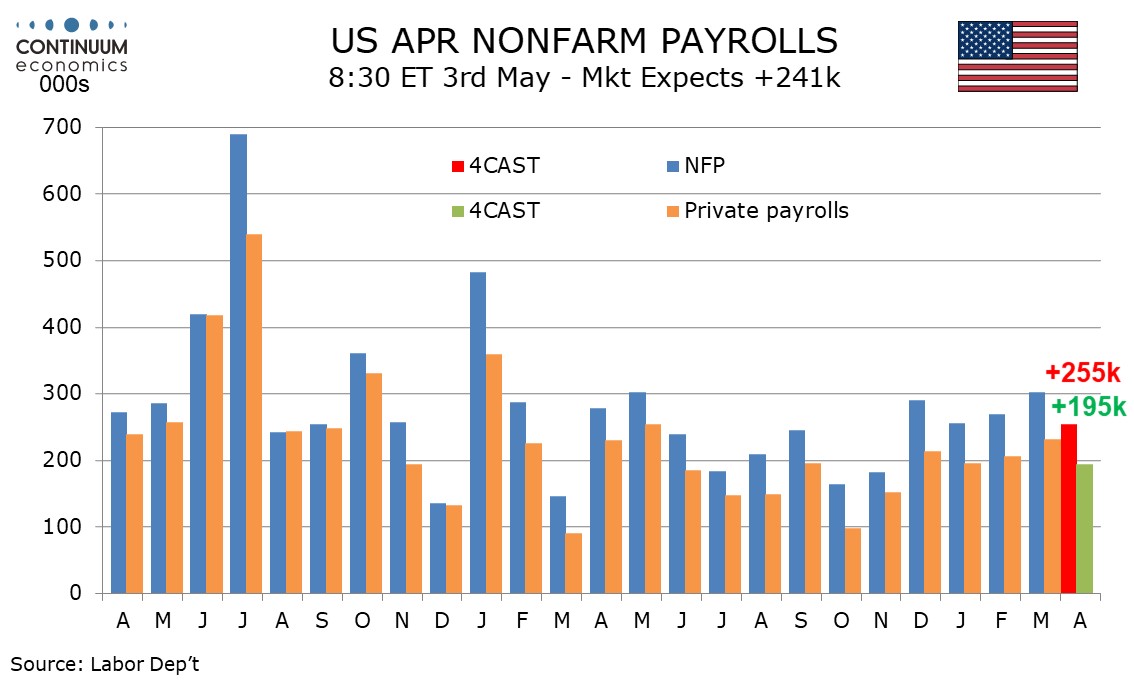

Preview: Due May 3 - U.S. April Employment (Non-Farm Payrolls) - Still strong if a little less so, earnings may be above trend

May 2, 2024 2:03 PM UTC

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in Cali

U.S. March trade balance little changed, Canada's moves into deficit

May 2, 2024 1:33 PM UTC

March’s US trade deficit of $69.4bn was marginally down from $69.5bn in February as a deterioration on the goods deficit was offset by a correction higher in the services surplus. Canada’s trade data was more surprising, a C$2.23bn deficit, and the largest deficit since June 2023.

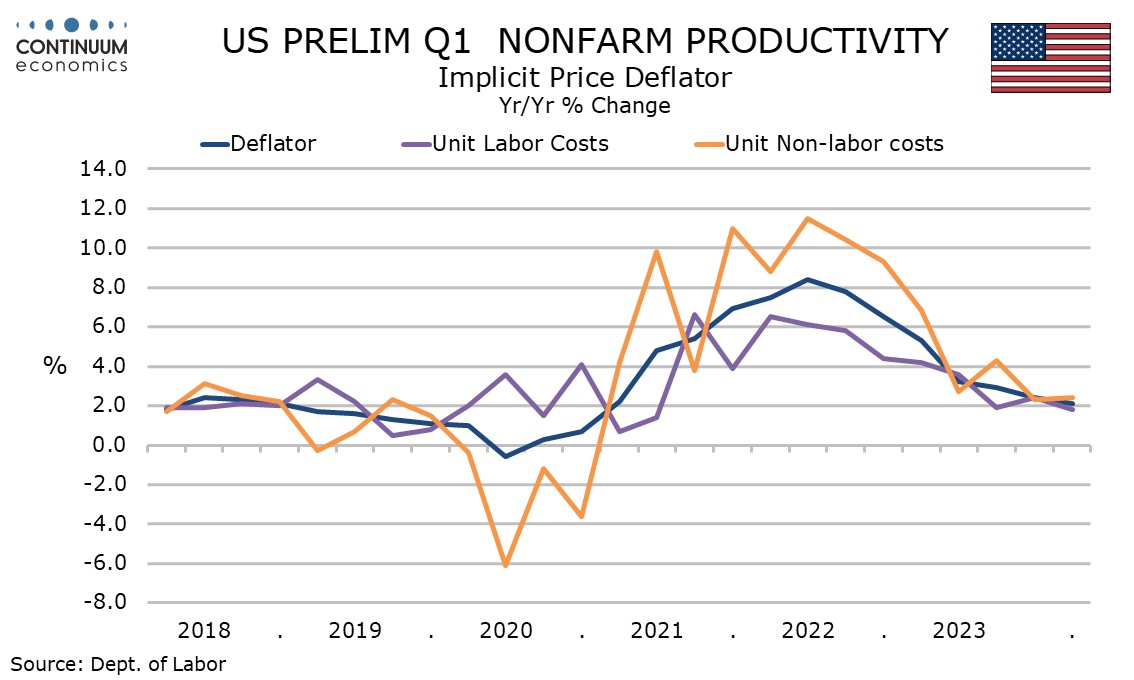

U.S. Unit Labor Costs and Initial Claims suggest inflationary risk from labor market strength

May 2, 2024 12:56 PM UTC

Initial claims at 208k are unchanged at a very low level while continued claims at 1774k are also unchanged, the preceding data revised from 207k and 1781k respectively. The labor market remains tight while unit labor costs saw a significant bounce to 4.7% annualized in Q1.

BoE Preview (May 9): Easing Bias Clearer?

May 2, 2024 11:06 AM UTC

In flagging no need to be dominated by Fed policy, we think that the BoE is not only moving towards rate cuts but the MPC majority may be overtly advertising such a likelihood. But we do not see any move at the looming May 9 verdict, with Bank Rate again likely to remain at 5.25%. But the accompan

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

May 01, 2024

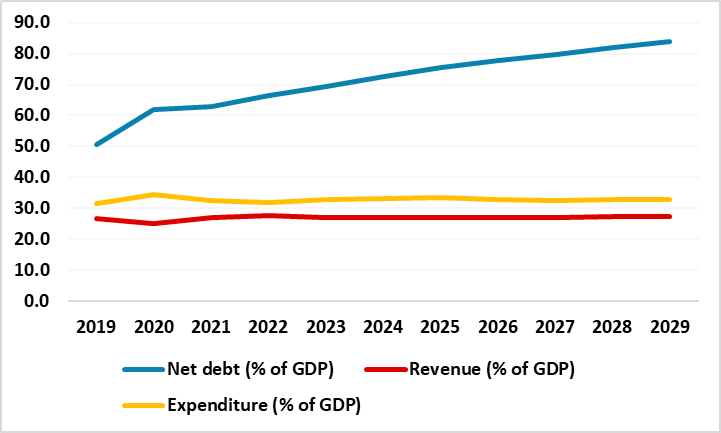

South Africa’s Fiscal Outlook Under Spotlights as the Elections Are Approaching

May 1, 2024 6:45 PM UTC

Bottom line: South Africa policy makers remain concerned about government debt trajectory, large domestic and international financing needs and elevated country risk premium before fast-approaching elections on May 29. We think South Africa’s general government fiscal balance and debt trajectory w