View:

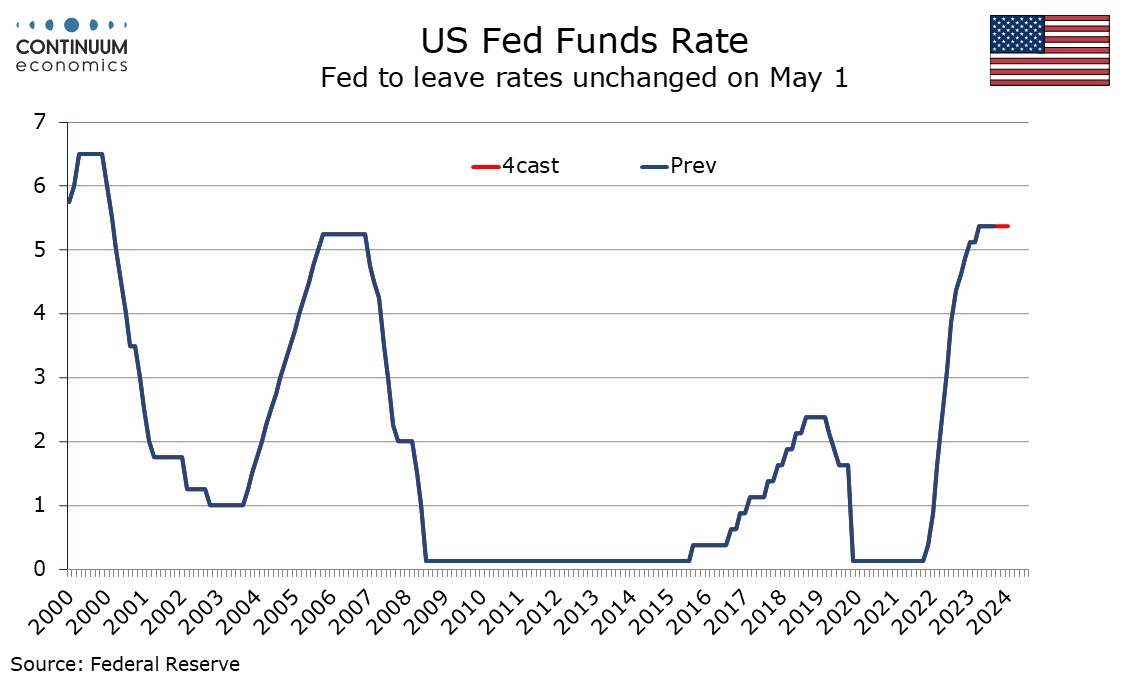

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

April 24, 2024 6:44 PM UTC

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and

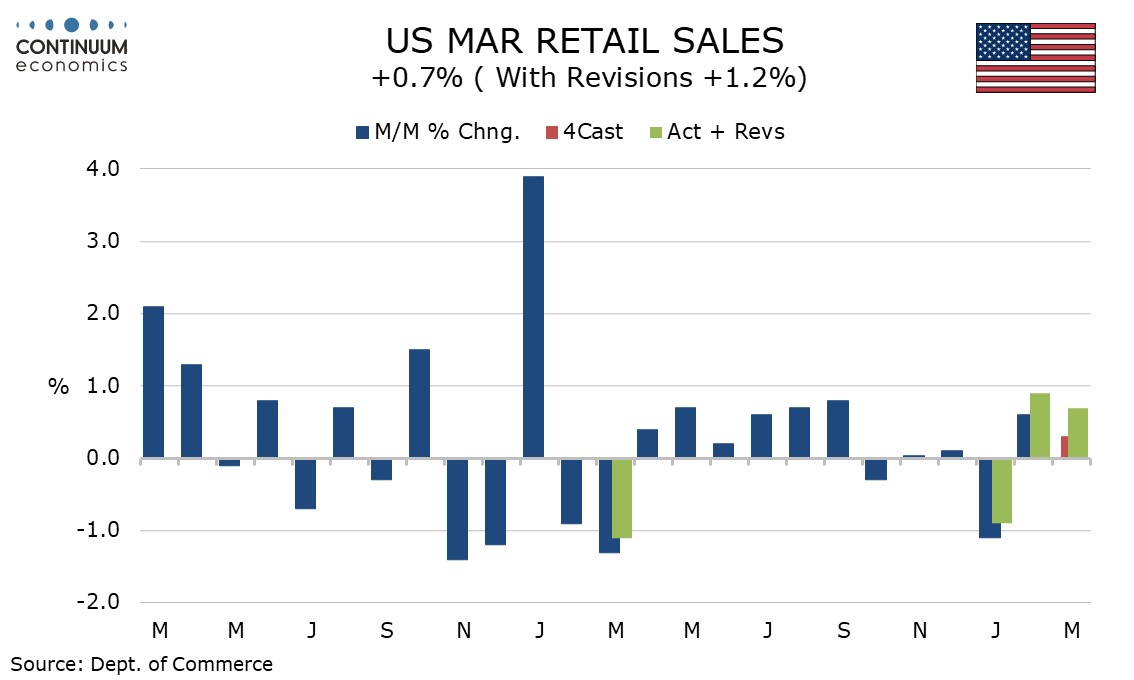

U.S. March Retail Sales allow Q1 to come in marginally positive despite a weak start in January

April 15, 2024 12:56 PM UTC

March retail sales with a 0.7% increase have exceeded expectations despite an expected negative contribution from autos, with sales up by 1.1% both ex autos and in the control group that contributes to GDP, and by 1.0% ex autos and gasoline. This suggest continued consumer momentum entering Q2.

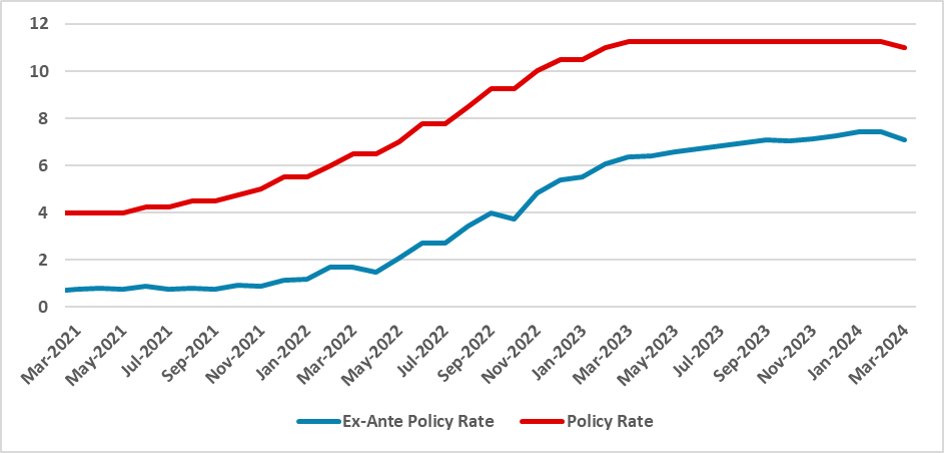

Banxico Minutes: Hawkish Cut and Different Views

April 5, 2024 2:18 PM UTC

Banxico's recent meeting minutes reveal a split among board members regarding monetary policy, with a 25bps rate cut to 11.0%. Despite progress in curbing inflation, differing views on policy direction persist. Inflation expectations deviate from targets, with potential risks in fiscal policy and wa

Canada March Employment - A weak month after two solid ones

April 5, 2024 1:35 PM UTC

Canada’s 2.2k decline in March employment is weaker than expected though needs to be seen alongside strong gains of 40.7k in February and 37.7k in January. The 3-month average of 25k is above the 6-month average of 22k. However with the labor force rising unemployment is trending higher, March’s

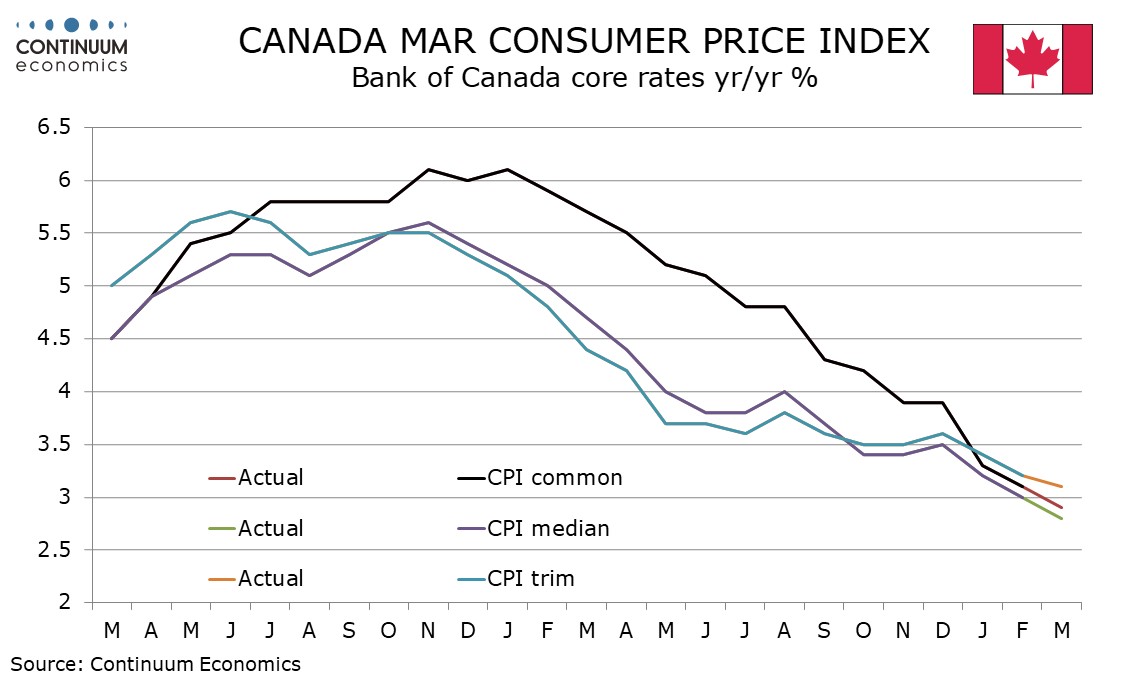

Preview: Due April 16 - Canada March CPI - Correction after two soft months

April 15, 2024 1:22 PM UTC

We expect March Canadian CPI to move higher to 3.0% yr/yr from 2.8% in February and 2.9% in January, with the monthly data likely to look quite firm after two soft months. However we do expect some modest progress lower in two of the three BoC’s core rates.

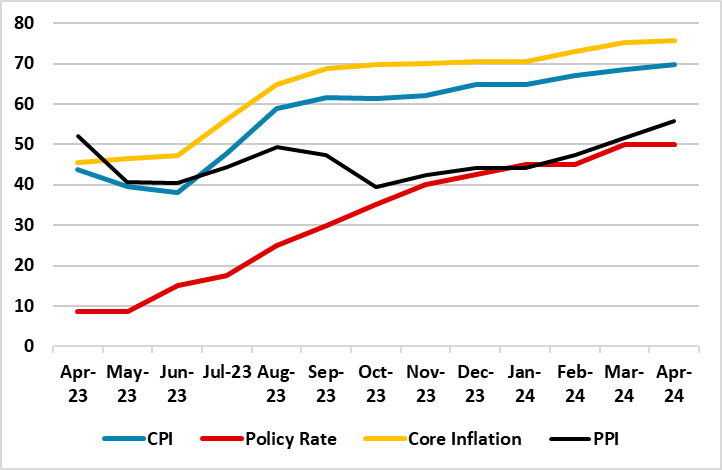

Turkiye’s Inflation Continues to Jump in April with 69.8%

May 3, 2024 7:40 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 3 that Turkish CPI ticked up 69.8% annually and 3.2% monthly in April due to increases in transportation, restaurant & hotel and education prices, coupled with the lingering impacts of the wage hikes on the services sector. We feel u

FX Daily Strategy: Europe, May 3rd

May 3, 2024 5:57 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

Asia Open - Overnight Highlights

May 3, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly stronger against the USD as the greenback continue to drift lower after the less hawkish than expected FOMC. IDR saw the largest gains of 0.46%, followed by KRW 0.45%, SGD 0.44%, PHP 0.4%, CNH 0.39%, MYR 0.38%, THB 0.29%, TWD 0.18% and HKD 0.13%.

USD/CNH is t

FX Daily Strategy: Asia, May 3rd

May 2, 2024 9:00 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady